AES: Sahel Alliance implements groundbreaking customs levy to boost regional integration

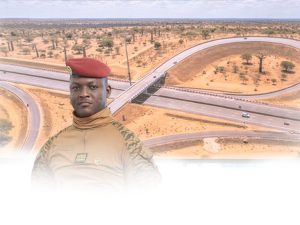

The Alliance of Sahel States (AES) has taken a decisive step toward economic sovereignty with the introduction of a new 0.5% confederal levy on imports from non-member countries. Approved by the heads of Mali, Niger, and Burkina Faso under the leadership of Colonel Assimi Goïta, this strategic measure aims to generate sustainable funding for regional integration projects and institutional operations.

Key features of the new policy:

- Selective application: The tax targets only non-AES imports, excluding goods in transit, intra-alliance trade, and products from nations with existing customs agreements.

- Humanitarian exemptions: Critical items including humanitarian aid, third-party hydrocarbons, and personal traveler effects remain untaxed.

- Dedicated funding pool: Collected revenues will be managed collectively by member states’ finance ministers to support:

The AES Federal Investment Bank

• Operational expenditures

• Cross-border solidarity initiatives

Strategic implications:

This fiscal innovation marks a pivotal shift toward self-reliance for the Sahel nations, reducing dependency on external financing while accelerating joint infrastructure and development programs.

By shielding regional trade while capitalizing on global imports, the AES creates a balanced model for economic growth amidst geopolitical challenges.

The move underscores the bloc’s commitment to practical sovereignty – transforming policy rhetoric into actionable financial mechanisms that directly fuel Sahelian autonomy.

Titi KEITA